cryptocurrency tax calculator reddit

The internal revenue service irs recognizes any income generated by trading cryptocurrency or accepting cryptos for goods and services as taxable. Join over 100000 crypto investors calculating their profits losses and tax liabilities today.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

IRS Added a Question on Crypto Usage to Income Tax Form.

. 0325 5000 1625. Your first 12570 of income in the UK is tax free for the 20212022 tax year. We help you generate IRS compliant tax reports while maximizing your refund.

SUBX helps businesses and projects integrate web3 technologies into their products and services. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. This is a site wide rule and a subreddit rule.

Cryptocurrency tax is a new and emerging space in Canada with much speculation about different crypto. Simply put they allow businesses to innovate with blockchain metaverse and Defi technology. Please note that Rule 4 does not allow for Tax Evasion.

This matters for your crypto because you subtract this amount when calculating what. Bonus 7 must follow twitter accounts for new traders. The internal revenue service irs recognizes any income generated by trading cryptocurrency or accepting cryptos for goods and services as taxable.

It looks like this post is about taxes. Tax laws vary between countries so you may get more helpful replies if you specify the place you are asking about. It looks like this post is about taxes.

Crypto taxpayers can use the Libra Tax calculator for free for up to 500 transactions while the paid subscription allows them to track 5000. You report these taxable events on your tax return using various. Janes estimated capital gains tax on her crypto asset sale is 1625.

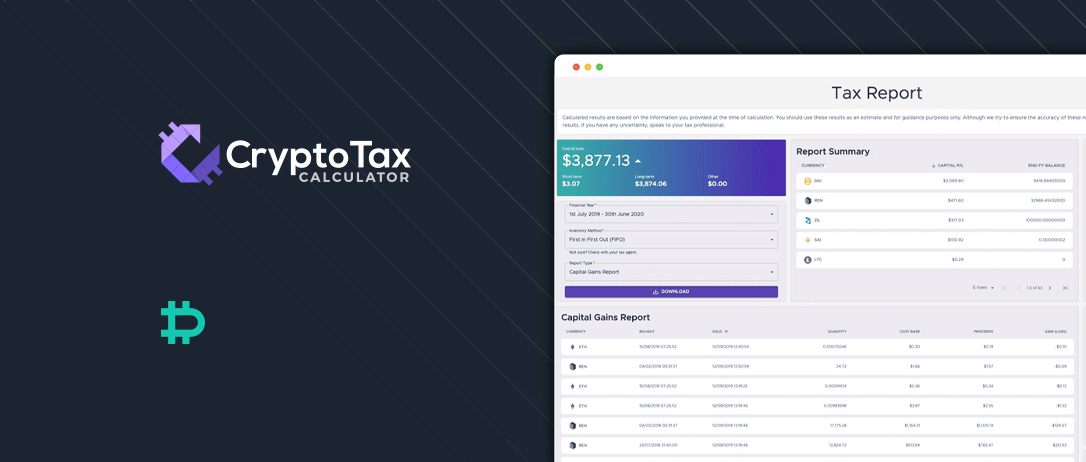

This is why cryptocurrency tax Shane explains is kind of a lagging market. It serves as a one-stop shop to handle cryptocurrency tax reporting for all types of cryptocurrency use cases whether you are mining staking lending or simply buying or trading CryptoTraderTax will automate your tax reporting. It was developed with the.

Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. Easily calculate your cryptocurrency taxes. Crypto tax breaks.

Depending on your tax bracket for ordinary income tax purposes long-term capital gains which are recognized when an asset is held for at least one year one day are taxed at a rate of 0 15 or 20. We dont accept any new clients for 2021 tax season see you next year. Heres an example of how to calculate the cost basis of your cryptocurrency.

Do not endorse suggest advocate instruct others or ask for help with tax evasion. When you earn income from cryptocurrency activities this is taxed as ordinary income. UK crypto investors can pay less tax on crypto by making the most of tax breaks.

Taxpayers should also seek guidance on how to calculate the sales tax due on purchases made with virtual currency or cryptocurrency and how to report such sales to state taxing authorities. CryptoTraderTax is the easiest and most intuitive crypto tax calculating software. Please note that Rule 4 does not allow for Tax Evasion.

Zenledger is another provider of tax calculation services for crypto investors. Do not endorse suggest advocate instruct others or ask for help with tax evasion. This allowance was 12500 for the 20202021 tax year.

TokenTax is one of the most extensive tax calculation and reporting software out there for any crypto trader. Were still picking up a lot of customers who were trading in 20172018. Best Crypto tax reporting and calculation software.

Indian government just announced that crypto will be taxed at 30 of gains. Online Crypto Tax Calculator with support for over 400 integrations. SUBX FINANCE LAB is a blockchain-as-a-service provider fast-rising in Singapore.

Crypto taxpayers can use the libra tax calculator for free for up to 500 transactions while the paid subscription allows them to track 5000. This is the first time the Indian government is discussing crypto taxation. Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms.

Business expenses will also not be allowed. Simple accurate and trusted. It looks like this post is about taxes.

Do not endorse suggest advocate instruct others or ask for help with tax evasion. This is a site wide rule and a subreddit rule. The premium service provides the option to download tax reports.

The resulting number is your cost basis 10000 1000 10. The brothers founded the. SUBX helps businesses and projects integrate web3 technologies into their products and services.

Initial purchase price of 5 x 25 units 125. Zen Ledgers Bitcoin Crypto Tax Calculator. The tax rate on this particular bracket is 325.

49 for all financial years. Simply put they allow businesses to innovate with blockchain metaverse and Defi technology. Remaining units 75-50 25 so we need to include 25 units from the earlier sale to calculate our start balance.

CryptoTraderTax is the fastest and easiest crypto tax calculator. Tax laws vary between countries so you may get more helpful replies if you specify the place you are asking about. This handy guide will give you a complete state-by-state breakdown of cryptocurrency tax laws and regulations.

Data on this page is updated as of. Supports DeFi NFTs and decentralized exchanges. 12570 Personal Income Tax Allowance.

Sort out your crypto tax nightmare. In my opinion at the tax year end you should NEVER have unrealized losses. The IRS treats cryptocurrency as property meaning that when you buy sell or exchange it this counts as a taxable event and results in either a capital gain or loss.

The tax will apply to all gains on digital virtual assets and no capital losses will be allowed. This is a site wide rule and a subreddit rule. They compute the profits losses and income from your.

Tax laws vary between countries so you may get more helpful replies if you specify the place you are asking about. Please note that Rule 4 does not allow for Tax Evasion. So unrealized gains 600 - 200125 275.

The platform has made the entire process hassle-free by integrating with almost every crypto exchange out there. SUBX FINANCE LAB is a blockchain-as-a-service provider fast-rising in Singapore. Free crypto tax calculator canada reddit.

Take the initial investment amount lets assume it is 1000. How much tax you pay will depend on how long you hold your Bitcoin. Ethereum Solana and more.

Bitcoin Taxes Bitcointax Twitter

Hmrc Cryptocurrency Tax Guide 2020 Updated R Bitcoinuk

How To Calculate Crypto Taxes Koinly

I Created A Free Tax Calculator And Subtly Promote Nano In It Please Read R Nanocurrency

22 Best Reddit Personal Finance Communities For Entrepreneurs And Business Owners Personal Finance Finance Finance Guide

Gbtc Bitcoin How Fo You Buy Bitcoin How To Buy Bitcoin Cash Where To Spend Cryptocurrency Lifetime Bitcoin Mining Contr Bitcoin Buy Bitcoin Bitcoin Mining Rigs

Bitcoin Taxes Bitcointax Twitter

Bitcoin Taxes Bitcointax Twitter

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Bitcoin Taxes Bitcointax Twitter

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Bitcoin Taxes Bitcointax Twitter

Bitcoin Taxes Bitcointax Twitter

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

14 Best Crypto Exchanges In The Uk 2022

New Partner Cryptotaxcalculator Deribit Insights