do travel nurses pay state taxes

There are two ways you can be paid as a travel nurse. For more on how state income tax impacts travel nurse salary seek the advice of a tax professional who is familiar with filing state income taxes for travel healthcare professionals.

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Two basic principles are at work here.

. Where do travel nurses pay state income taxes. Know about State Income Tax. State travel tax for Travel Nurses.

22 for taxable income between 40126 and 85525. Its also worth really familiarizing yourself with the tax. Each state return cannot be prepared in a vacuum as the results on one can be dependent on the other.

On top of that very rarely do travel nurses get to file as an independent contractor. You will owe both state where applicable and federal taxes like everyone else. 24 for taxable income between 85526 and.

You will pay state income taxes in whichever state you work. Here are some categories of travel nurse tax deductions to be aware of. It is common practice for states that charge income tax to tax travel nurses even though they might not be.

This is the most common Tax Questions of Travel Nurses we receive all year. As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees. You will also need to pay estimated taxes since there are no tax withholdings for independent.

Basically only income earned in California is taxed there. Youll be glad to know there are two tax-exempt options for travel nurses nowadays keeping in mind local and federal tax. Travel nurses are paid a blended rate of tax-free stipends and taxable hourly wage.

First things first you have to know this. It is also the most important since the determination of whether per diems stipends. The most prominent Travel Nurse Tax Deductions are Tax-Free Stipends for Housing Meals Incidentals Travel Reimbursements and Professional Development Costs.

You may be subject to state income tax in both the state of your permanent residence and the states where you had travel nurse jobs. Do travel nurses pay state income tax in states where they work. For state taxes remember to file before the April 15th deadline.

This is because travel nurses are paid a base hourly rate that is taxable and a weekly travel stipend that is not taxable both of which equal their total pay in a given contract. View the job description responsibilities and qualifications for this position. You are not entitled to tax-free money just because you are a nurse who is taking a 13-week contract in a new state.

But many states including California use a percentage based approach to figuring out taxes. Every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have. Because Travel Nursing makes filing taxes more complex however the IRS is.

12 for taxable income between 9876 and 40125. Research salary company info career paths and. But state law company policies and the terms of your travel nursing assignment contract may provide additional overtime pay and an increased holiday pay rate.

In most situations yes. Travel expenses from your tax home to your work. 1099 employees expecting to owe over 1000 in taxes.

The only condition to. 2000 a month for. Not just at tax time.

Here is an example of a typical pay package. Nursing explains that every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in as well as the state thats your. Make sure to check state laws as you may end up paying state income.

There are lots of travel nurses who travel and. Or are paid a fully taxable hourly wage taxed on the. Apply for the Job in NICU Travel RN at Anchorage AK.

250 per week for meals and incidentals non-taxable. As a travel nurse working outside of your tax home you are eligible for tax-free stipends in addition to the hourly wages you earn. 20 per hour taxable base rate that is reported to the IRS.

Travel nurse taxes are due on April 15th just like other individual income tax returns. 10 for the first 9875 in taxable income. The expense of maintaining your tax home.

First your home state will tax all income earned.

What Is Travel Nursing How To Become A Travel Nurse Salary Registerednursing Org

State Tax Questions American Traveler

How To Make The Most Money As A Travel Nurse

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

How Much Do Travel Nurses Make Factors That Stack On The Cash

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

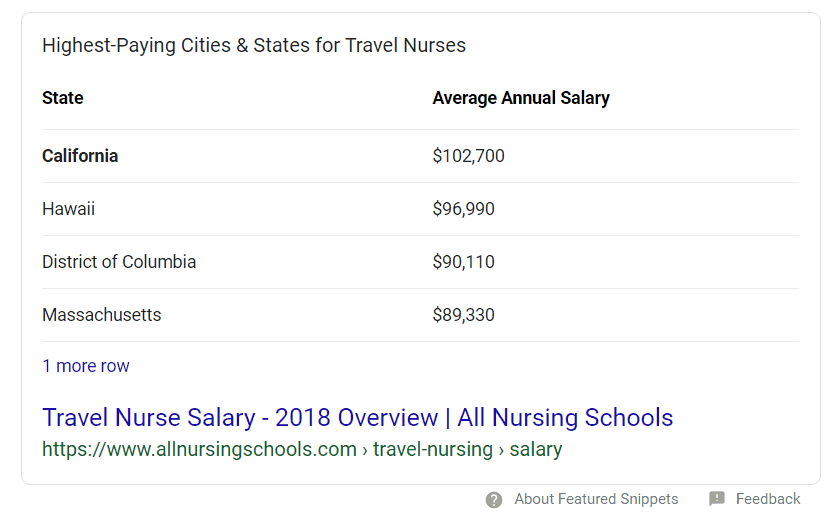

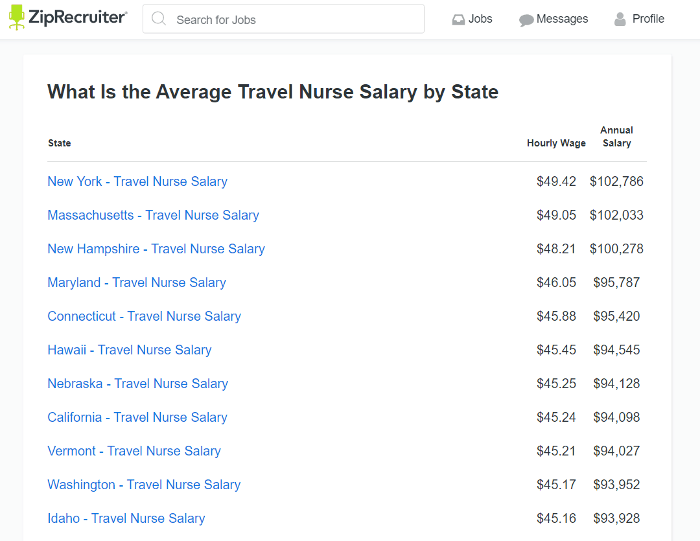

Complete List Of Average Nursing And Travel Nursing Salaries By State By Nomad Health Nomad Health Medium

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Understanding Pay Packages For Traveling Nurses 2021 Marvel Medical Staffing

How Long Can A Travel Nurse Stay In One Place Theraex Staffing

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

The Benefits Of Travel Nursing Learn More And Apply Abbella Medical Staffing

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

What Is Travel Nursing Academia Labs

Trusted Event Travel Nurse Taxes 101 Youtube

Travel Nurse Taxes All You Need To Know Origin Travel Nurses